The Historic Homes Rehabilitation Tax Credit (HHRTC) is designed to encourage new home ownership of historic homes and to assist homeowners in maintaining and/or rehabilitating their historic houses.

The Historic Homes Rehabilitation Tax Credit (HHRTC) is designed to encourage new home ownership of historic homes and to assist homeowners in maintaining and/or rehabilitating their historic houses.

- The HHRTC provides a 30% tax credit for qualified expenses, up to $30,000 per dwelling unit, for the rehabilitation of one to four unit buildings.

- After completion of rehabilitation work, one unit must be owner-occupied for a period of five years.

- Although technically a tax credit, homeowners receive a state tax voucher at the end of the process which they in turn sell to a qualified entity (i.e. Eversource).

HPA is happy to provides low-cost assistance to homeowners located in Hartford area with their tax credit application. Contact Mary Falvey, mary@hartfordpreservation.org or 860.570.0331.

Eligible Properties:

One to four unit dwellings listed (either individually or in a historic district) on the State and/or National Register of Historic Places

See Hartford Properties Listed on State and National Registers of Historic Places

Eligible Owners:

- Individual homeowners and local non-profit Community Housing Development Corporations.

- Individual homeowners must occupy the property for five years after completion of the rehabilitation work.

Eligible expenses:

- Requires a minimum of $15,000 in qualified rehabilitation expenses

- 65% of total qualifying expenditures must include work directly attributable to the long-term preservation of the historic building fabric and character-defining features. (see Sample Calculations below)

ALL WORK being done on the property must comply with the Secretary of the Interior’s Standards for the Rehabilitation of Historic Properties not just work for which tax credits are being applied for.

Common items of qualified rehabilitation work include (but are not necessarily limited to):

Foundation

Walls

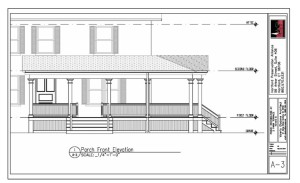

Porches

Windows

Roof

Chimney

Doors (interior & exterior)

Interior decorative features and details including ceiling ornamentation, moldings or medallions

Mechanical systems including HVAC, plumbing and electrical wiring

Generally not approved:

Replacement windows

Replacing “Yankee” or built-in gutters

Wholesale removal of siding

Blown-in foam insulation

Plastic/vinyl trim

Drywall laminated to plaster ceilings

“Permanent” Paint Products

Ineligible Expenses

Permits and fees

Architectural, Engineering and Design Costs

Landscaping/Site Work

Driveways and Sidewalks

Fencing

New Construction

Personal Labor

Sample Calculations:

Sample #1:

$15,000 – new roof

$5,000 – chimney repointing

$5,000 – electrical upgrades

$60,000 – kitchen renovation

$25,000 of proposed project costs (roof, chimney repairs & electric upgrade) are qualified expenses directly attributable to the long-term preservation of the historic building fabric and character-defining features

Total expenses eligible for tax credit = $38,461.54 ($25,000/65 X 100)

Eligible expenses $38,461.54 X 30% = $11,538.46 tax credit amount

Sample #2:

$15,000 – new roof

$5,000 – chimney repointing

$5,000 – electrical upgrades

$5,000 – repair wooden windows

$30,000 (all) of project costs are qualified expenses

Eligible expenses $30,000 X 30% = $9,000 tax credit amount

APPLICATION PROCESS

- Work to be completed MUST BE APPROVED by the State Historic Preservation Office BEFORE any project work is started

- Due to a high volume of applications, please factor in a minimum 30 day review period for an initial project approval from the State Historic Preservation Office

For further information and questions contact erin.fink@ct.gov or mary@hartfordpreservation.org

EFFECTIVE MARCH 17, 2020 all applications for the Historic Homes Tax Credit must be sent via e-mail to erin.fink@ct.gov.

GENERAL INSTRUCTIONS FOR COMPLETING TAX APPLICATION

Part 1 Application

Part 2 Application

Part 2 Amendment Please note: Amendments to work project must be submitted for review and approval before prior to beginning the work or you risk losing your tax credit reservation.

Part 3 Application

Part 4 Application

Historic Homes Rehabilitation Tax Credit Regulations